I Grew up Poor and I Hate Money (but I need to change that)

Healing my relationship with money, and merging that with my writing life.

This post discusses suicide.

Growing up Poor = Wanting and Fearing Money

As a child, I was steeped in financial literacy. Or, rather, I knew a certain language when it came to money. My single mother had nice clothes, and we would pack them up in boxes each time our rent was raised so we could find somewhere cheaper to live. She bought those clothes with credit cards, and I learned to answer the phone using my professional voice, ready to say, “I’m sorry, she’s not available, can I take a message?”

We were poor. The way our poverty marked us was clear: my mom overspent because the nice clothes created a middle-class illusion. She was a secretary. My clothes were not nice, and that meant I was often alone at school. I smelled of cigarette smoke and wore cheap leggings and floppy, falling-apart shoes. I envied the kids at school who had name brand everything. Levi’s, Gap, Banana Republic. Every little thing has a brand name and generic version. I always got the generic. I wanted the brand name.

My mother was obsessed with money. When she married into it I was thirteen. She sacrificed me for a husband who paid off her credit cards and bought us a house. An alcoholic and an abuser, but with money. I had nicer clothes, and access to nicer things, and I rejected them all because they were tied to my behavior. I would not call him “dad,” and therefore I was grounded.

It’s hard for me to explain my relationship with money, but I will say that once I left the house my mom used money to control our relationship. I struggled financially and she swooped in and saved me but once I took the money I was obliged to endure verbal abuse without complaint. I learned to equate money with a loss of power rather than an accumulation of power.

When my mom died by suicide almost twelve years ago she was divorced and broke. She had spent her half a million dollar divorce settlement on exorbitant rent, good wine, eating out, a younger boyfriend, and trips to Costco accumulating goods that she kept in her rental basement. In her suicide note she said she was too old to start over, and the money was running out.

Spending money because…what else is it for?

I did not get an inheritance. Rather, I got everything my mom had hoarded, and her Lexus. I hated driving that lovely, beautiful car with cherry wood paneling and leather seats. I didn’t want people to think I had money, because I didn’t have money. I sold it quickly and bought a cheap Honda Civic. After selling nearly everything I’d inherited, which added up to about $15k with the car, I paid for classes at the community college and continued to struggle financially. I moved to New York to finish my undergrad at Syracuse University. There, I had a budget of $45 a week and no good winter jacket. When the scholarships and award started rolling in, I spent them and didn’t save.

Spending and not saving is pretty much what I have always done. I do not have a savings account right now. And while some of that is for a valid reason (transitioning to freelance) I also know that it’s partially because of my own irresponsible spending. I buy things I don’t need. I buy things because they make me feel some kind of way.

In a few months I’ll be moving to Florida and starting life as a PhD candidate. I’m forty-one years old, and in August I’ll be forty-two. Yet my relationship with money is still FRAUGHT. Like, when I have money, I want to get rid of it. I spend it because I am scared of it, and then I shame myself for spending it.

Last year I took a course with Sara Faith Gottessdiener called “Money Alchemy.” While the course didn’t necessarily offer any solutions and/or help with managing money, it was an opportunity to dive into my own beliefs around money. It helped me ask myself: “are these beliefs mine?” and “are these beliefs productive and helpful?”

I have, for the most part, both rejected and longed for money throughout my life. Both of my parents were obsessed with money as a signifier of value and status, and both died poor. I have never had an income above 60k a year, and that one year was a fluke, not the norm.

And yet. Since leaving nannying, I have found myself snowballing into freelancing. I left my secure, full-time (with full benefits) nanny job last year (that was the 60k a year job) to try my hand at creating a writing life. And somehow, less than a year later, I am looking at a summer of actual income. Within the next week I’ll be signing contracts on two big writing jobs. This, along with some graphic design and marketing side-work, means I could actually be making more than what I need to survive for the first time since I left my nanny job.

I never, ever thought I could support myself as a writer, and have been told countless times that writing is not a good career choice, and yet my flexibility in the kind of writing I’m willing to do seems to be leading me towards an actual income.

What don’t I want to do? Make money and spend it, like I’ve always done.

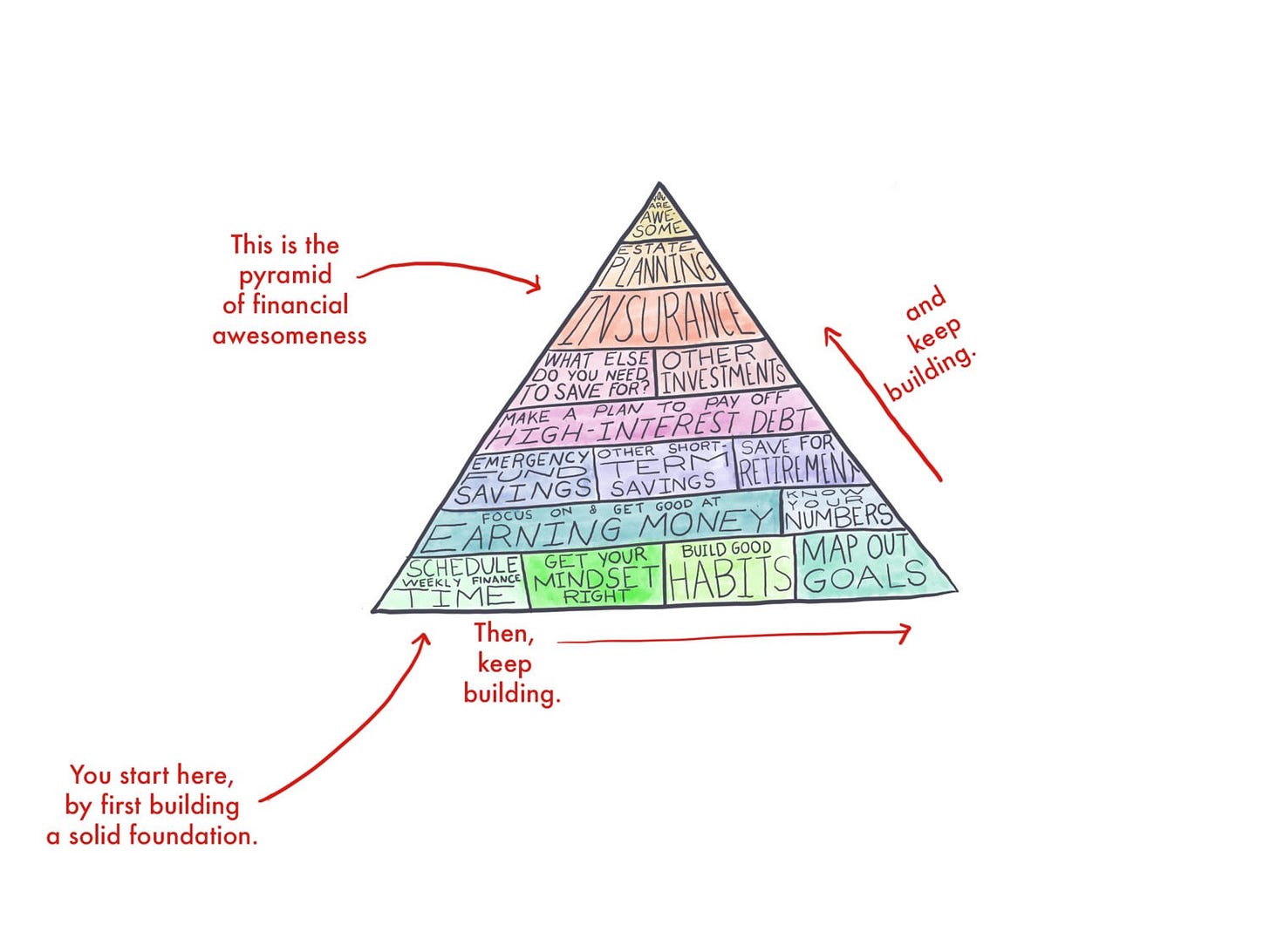

I know I’m not the only person with a terrible relationship with money. Only a few days ago I finished reading the excellent book Finance For The People by Paco de Leon, and it’s inspired me to get really serious about managing my finances. It also helped me understand why budgeting has never really worked for me.

Money is Power

Over the past few years It’s been on my radar that my relationship to money needs to change. I’ve been so busy, focused on many other changes that needed to happen, that I’ve not really delved too deeply. But now is the time. Years ago, I tossed around the idea of taking a year and not buying anything frivolous (if you know me, you know that I have a lot of ideas and about one percent of them actually get done).

I still want to do this, and maybe I will. Maybe, starting right now, or tomorrow, or Monday, I will go the entire rest of the spring and summer without buying anything I don’t actually need. It would certainly help make moving easier. When I was recovering from my eating disorder I stopped going to the gym for an entire summer, and that was incredibly productive and insightful. It helped me understand how I was equating my self-worth with going to the gym and working out. Maybe not buying frivolous things could work in a similar way.

Today I’ll start here. If you’re someone (perhaps a fellow writer) who struggles with your relationship to finances, I encourage you to answer these questions with me. You’re welcome to share in the comments if you’d like.

These are some (reworded) questions from Finance for the People:

Give an example from your childhood where you witnessed people stressing about money. How has this informed your relationship with money?

Do you have desires about money, abundance, and power that you feel like you have to disown in order to feel accepted?

Growing up, what were some stories you learned about the way money operates? What were the spoken and unspoken beliefs about money?

And here are a few questions I came up with, for myself:

How would your life be improved if you were more intentional about your spending?

Have you ever made a purchase you regretted? Why did you regret it?

How much of your self-identification has to do with your attachment to having or not having money?

Who am I if I am not poor?

Something I’ve learned about myself is that I identify as poor. I grew up poor, and I feel an allegiance to people living in poverty. This also means that I feel guilty whenever I am living in any state of abundance, because I know that there are people who are still suffering, without enough resources to meet their basic needs. Simultaneously, I am judgmental of people who own an abundance of very expensive things; my mom’s Lexus for example. Why have an expensive car when you could donate that money and change someone’s life by helping them pay for college?

I’m no longer poor. It’s true. I live in a one-bedroom apartment in Seattle, where rents are exorbitant. I make enough to feed myself well. I can buy the occasional new article of clothing. Yet I also have credit card and student loan debt and arguably live above my means. Truthfully, I don’t know where I’m at financially. That’s the problem.

But my emotional, subconscious (and conscious) beliefs about money are the actual problem. I don’t have a good sense of my finances because I don’t want to look at them. I don’t want to know what I have or don’t have, because I have negative beliefs about being rich and poor and everything in between.

I have a terrible relationship with money.

So, a reframe is entirely necessary. Reframe is such a tidy word, but it’s a lot of work to truly bring a new understanding to an entire picture.

What if I can get a handle on my finances and actually learn to save, and feel less unstable?

What if, in doing that, I am able to contribute more intentionally to the causes and communities I care about? What if being in abundance, and feeling like I have enough, means that I am more able to step into my power as a writer and human, with less baggage or hangups? And what if I stopped judging others for what they decide to do with their money.

These are all the questions I am considering. I do know that I am taking de Leon’s advice and setting aside time each week to contemplate my finances and take action where needed. As I start these new projects, I must protect myself from myself.

No new things I don’t need.

Instead, a savings account.